Who doesn’t love extra funding?

Nobody, of course.

But when that funding comes from the government, there are always strings attached and often some confusion.

The 2022 payout of eFMAP funds is a great example. Agencies received their money in March, but questions still linger:

- How did agencies qualify?

- How were allocations made?

- What are allowable expenses?

And the crucial question:

How can you leverage eFMAP money to benefit and grow your agency?

Jamie Bayof of GlattHealth Consulting Group works with home healthcare agencies to finds answers. “To fully understand the topic, we need to go back to March 2021,” he explains.

eFMAP

How would you spend $2B?

That’s the question NY State faced in the spring of 2021.

On March 11, 2021, Congress signed The American Rescue Plan Act (ARPA). Most people called it the COVID-19 Stimulus Package, and it poured $1.9 trillion into the American economy.

Section 9817 gave state Medicaid programs a 10% increase in their Federal Medical Assistance Percentages (FMAPs). FMAPs are unique percentages by which the federal government reimburses each state for its Medicaid expenditures.

The enhanced FMAP (eFMAP) applied to state Medicaid expenditures from April 1, 2021 to March 30, 2022. Although FMAP funds are usually a reimbursement, states were required to spend these eFMAP funds before March 31, 2024 to:

- Enhance investments in home and community-based services (HCBS),

- Address COVID-related needs,

- Build HCBS capacity.

States’ eFMAP spending plans were subject to approval by The Centers for Medicare & Medicaid Services (CMS).

New York’s Spending Plan

In July 2021, New York’s Department of Health (DOH) presented a 51-page Spending Plan to the CMS. NY’s eFMAP funds totaled $2,146,000,000. The state would allocate that money to more than 30 programs in 3 categories:

- Supporting & Strengthening the Direct Care Workforce

- HCBS Capacity, Innovations, and Systems Transformation

- Digital Infrastructure Investments

The programs address the wide range of HCBS. Each one is being rolled out to specific providers with distinct goals, terms, and timetables. To give just a few examples:

- Expanded Capacity in NHTD-TBI Waivers increases resources to reduce nursing home admissions for New Yorkers who are elderly, disabled, or have experienced a traumatic brain injury.

- COVID-19 Workforce Performance Incentives offer stipends to aides who worked during COVID and are still employed in the OPWDD (Office for People With Developmental Disabilities) service system.

- The Workforce Transportation Incentive supports initiatives such as agency-supplied car services for HHAs or passes for public transportation.

“Reach out to us if you think you’re eligible for any of the eFMAP programs,” says Jamie. “We can assist you with applying to the programs and determining what are allowed expenses and approved uses.”

LTC Workforce and Value-Based Payment (VBP) Readiness

By far the most expensive and expansive of NY’s HCBS eFMAP initiatives is the LTC Workforce and Value-Based Payment Readiness program. So much so that within the industry, “FMAP” has come to mean this program only—despite the 29+ others! NY State refers to this program as its “workforce investments.”

As its name implies, LTCW/VBP Readiness has two goals:

- Improve recruitment and retention to increase the HCBS workforce. High turnover has always been an industry problem, and there’s a severe employee shortage today. The DOH would also like a more diverse workforce. Research proves that patients fare better with culturally compatible caregivers.

- Transition home healthcare workers to a VBP model where payment is linked to quality performance. The hope is to improve patient outcomes, reduce hospitalizations, and reward excellent caregivers.

Qualifying for Funding

Only Licensed Home Care Services Agencies (LHCSAs) can receive LTCW/VBP funding. Agencies were eligible based on their 2019 managed care revenue.

Medicaid divides NY State into four regions. For each region, the DOH considered providers in the 66th revenue percentile or above. Some agencies were eligible in multiple regions, so although the total awardees were 235, there were only 212 unique agencies.

| Region | # of LHCSAs

in Top Third |

| NYC Area | 154 |

| Mid-Hudson/Northern Metro | 28 |

| Northeast/Western | 30 |

| Rest of State | 23 |

| Total | 235 |

“That’s only one-third of New York’s LHCSAs,” explains Jamie, “But those agencies directly or indirectly serve 93% of New York’s recipients.”

And what does this mean for smaller agencies who didn’t make the cut? “They may have trouble remaining competitive,” he admits.

Direct Payment Process

NY State split its workforce investments into two directed payments. The current one, for $361M, was paid to LHCSAs in March 2022. The exact date of the second payment has not yet been announced.

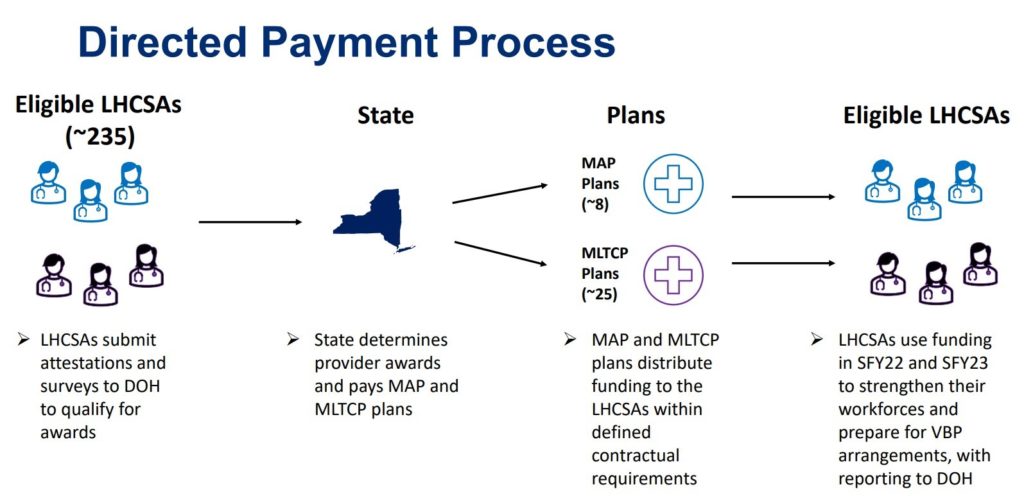

The DOH set up a multi-step process to distribute the funds:

- Eligible agencies didn’t automatically receive funding. In January 2022, they had to submit surveys and attestations to the DOH.

- The DOH allocated the funds among the agencies. “This is a point of confusion,” explains Jamie. “Eligibility was based on 2019 revenue. However, the allocations were based on an agency’s 2021 revenue.”

- In March 2022, the DOH paid the funds to MAP and MLTCP plans. The MAP and MLTCP plans then distributed the funds to the LHCSAs.

- The LHCSAs have until March 31, 2023, to spend the funds. Beginning July 1, 2022, they had to submit quarterly spending reports and survey responses to the DOH.

From the NYC DOH

Allowed expenses

“Agencies who received HCBS eFMAP funding are worried about spending it properly,” says Jamie. “They have to report their spending and could be audited.

“If they used it for non-approved purposes, they might not be eligible for future awards. Worse, they might have to pay the money back to the state.”

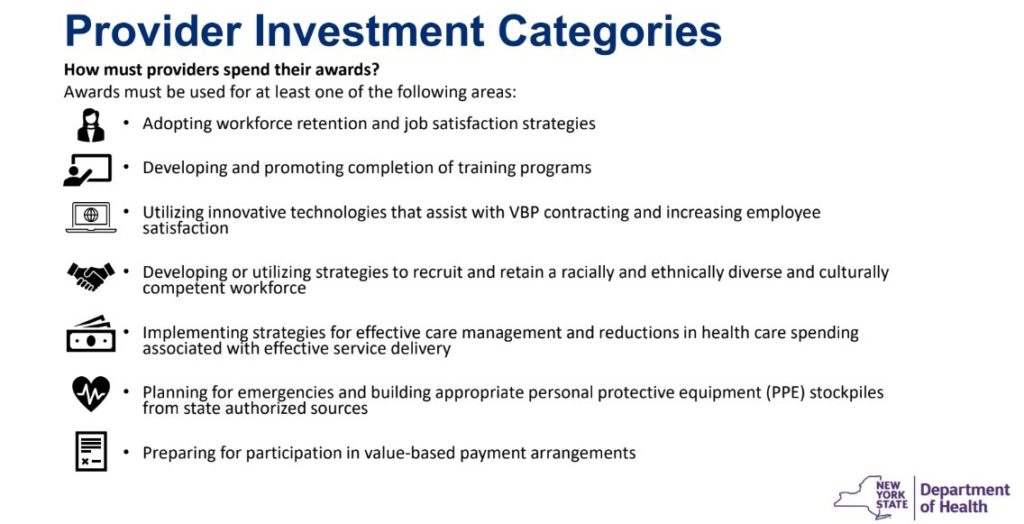

What are approved uses? The DOH identifies seven categories of allowed expenses for its workforce investments. It gives examples but leaves the door open for agencies to ask about specific cases:

1. Workforce Recruitment and Retention – Recognition and retention bonuses * Employee development and promotion initiatives * Enhanced job benefits * Pay raises

2. Training – Developing new training programs * Paid training opportunities * Incentives for completing training programs * Childcare coverage during training

3. Technology: Consumer-personal assistant matching technology * Incident tracking systems * Remote monitoring devices * Online access to service records and virtual visits

4. Diversity and Cultural Competency: Developing recruitment strategies for a racially and ethnically diverse workforce * Updating recruitment materials and external communications to include non-English language versions * Diversification of recruitment sources

5. Care Management: Developing roadmaps to best meet consumers’ individualized needs * Improving communication with clients’ support networks * Service planning processes and tools

6. Emergency Preparedness: New PPE * Prepared rapid training on infection control, virus testing, or natural disaster triage * Developing employee networks for backup providers.

7. Preparing for Value-Based Payment: Training staff to document value-focused indicators * Integrating value of care into job descriptions and employee performance expectations * Building capacity to collect and report data * Adopting key performance metrics.

Terms and Conditions

“When an agency comes to us for advice on spending its allocation, we go over the categories and brainstorm ideas,” says Jamie. “They see that it’s not so complicated, although you do need to follow the guidance provided.”

The guidance is extensive, but some of the allowable expenses are ambiguous. And the fine print matters. For example,

- Software investments are allowed; other capital expenses are not.

- Signing bonuses are allowable, but not if the employee was hired from another LHCSA.

- Transportation expenses for direct care workers are allowable, except for renting or leasing a vehicle.

But perhaps the biggest cause for concern is this: Funding must be spent on new or augmented programs, services, and/or purchases.

This condition gets tricky.

- The LTCW/VBP funds CAN’T be used to pay HHA’s salaries.

They CAN be used to fund raises, but ONLY IF those raises weren’t already planned.

- The LTCW/VBP funds CAN be used to offer health insurance as a benefit, but ONLY IF the agency doesn’t already provide it.

They CAN be used to expand a health insurance benefit, but ONLY IF the agency wasn’t already planning the expansion.

“There’s been some confusion, but if you have a question, you can submit it to the DOH,” explains Jamie. “They’ve been good about getting back to us.”

You can email the DOH at LHCSA.FMAP@health.ny.gov or check their website for more information.

Getting the most bang for your buck

“The HCBS eFMAP funds are a windfall,” says Jamie, “And you want to spend them most beneficially for your agency, your caregivers, and your patients.”

Giving back to caregivers, especially those that worked through COVID, is one effective way to do this. The HCBS eFMAP funds can be used to pay for new

- Bonuses

- Pay increases

- Benefits.

Hardworking aides deserve the reward and recognition. You and your patients benefit, too, since aides who feel appreciated are more likely to stay with an agency.

“We can help,” adds Shaya Sternhill, Melody Benefits Head Of Business Development & Sales. “Of course, eFMAP funds can’t be used to pay wage parity benefits. But as a wage parity TPA, we have proven systems for easy-to-administer benefits that employees love.

“Agencies that offer our benefits see lower turnover and higher employee satisfaction. And many of the benefits, such as health and transit, are allowable under HCBS eFMAP.”

If you already use wage parity benefits cards, consider adding eFMAP money to your employees’ cards. And if you don’t already offer a benefits card, this may be the perfect time to start.

“Speak to a benefits advisor and see what better benefits you can offer,” says Shaya. “Take advantage of the opportunities that eFMAP gives you.”