Is anyone in home healthcare NOT talking about the wage parity Annual Compliance Statement?

It’s new. It’s complicated. And there are criminal penalties on the line.

Mordechai Wolhendler, healthcare consultant at GlattHealth Consulting Group, offers some welcome advice and perspective. He explains how you can ace your Annual Compliance statement‒but why it needs your attention now.

Wage parity reporting review

First, a quick review of the certifications due on or before May 31 each year. The 20-21 NY State Budget mandates these forms to report information from the previous calendar year.

Providers, meaning LHCSAs (Licensed Home Care Services Agencies) and FIs (Fiscal Intermediaries), need to complete 3 certifications:

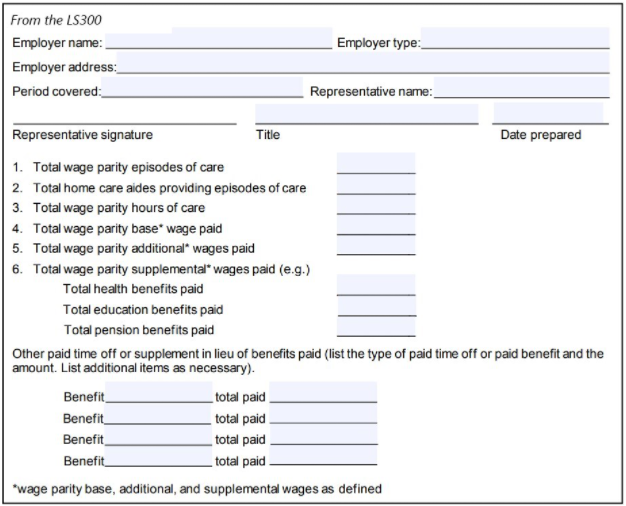

- Employer’s Annual Compliance Statement of Wage Parity, Hours and Expenses (LS300) – The LS300 asks for detailed information about the wage parity benefits you paid this year.

Providers must submit a separate LS300 to each payor (CHHA, MCO, or LTHHCP) with whom they contract.

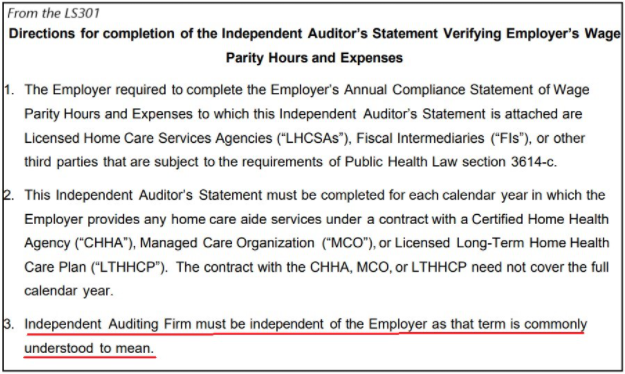

You can download the LS300 here. - Independent Auditor’s Statement Verifying Employer’s Wage Parity Hours and Expenses (LS301) – On the LS301, an independent auditor certifies that the provider’s Annual Compliance Statements are accurate. Only one LS301 is needed, but providers must send it to each payor. It also must be made available upon request to the New York State Department of Health (DOH) or the Department of Labor (DOL.)

You can download the LS301 here.

- Employer’s Annual Written Certification – Agencies submit this certification electronically to the DOH affirming that:

- Their services were fully compliant with wage parity laws.

- They didn’t take back any of their wage parity dollars.

- They will keep wage parity records for ten years.

- They submitted the LS300 and LS301 to each payor.

You can access this form through your eMedNY Provider Portal account.

Payors, meaning CHHAs (certified home health agencies), LTHHCPs (long-term home health care programs), or MCPs (managed care plans), also need to submit an Annual Wage Parity Certification. They affirm that:

- Their services were fully compliant with wage parity laws.

- They didn’t take back any of their wage parity dollars.

- They will keep wage parity records for ten years.

- They received, reviewed, and assessed the LS300 and LS301 of every provider with whom they contract.

- They will make a written referral to the DOL if they suspect that a provider didn’t conform to wage parity requirements.

Red lines — and gray areas

“No problem,” you might be thinking. “I don’t need to worry about this until May.” But Mordechai warns otherwise.

“We have a lot of questions about the new certifications,” he explains. “You need time to ask for guidance as gray areas come up.”

What gray areas?

- The LS301 must be completed by an independent auditor. You can’t audit yourself, but what does “independent” mean beyond the obvious? In its instructions, the LS301 offers only this circular explanation, underlined in red:

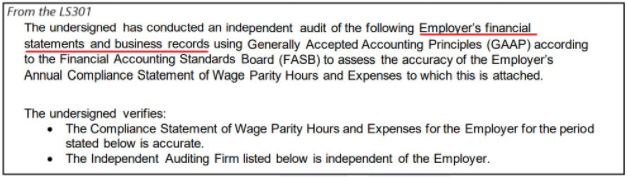

- What does the independent auditor need to review? Looking at the LS301 again, it references “financial statements and business records.” Do you need to generate your complete financials for your auditor to review? Or is it enough, as it seems when you read on, for your audit to verify that the financial information on your Compliance Statement is accurate?

- Wage parity law itself has areas that are interpreted differently depending on the attorneys. A CPA can verify that the Compliance Statement is accurate, but not if it’s lawful. What if your CPA notices a practice that falls into one of wage parity’s ambiguous zones? Can the CPA sign your certification?

- Fitting your benefits information accurately on the LS300 may be tricky and time-consuming. For each LS300, you need to specify which benefits were earned only under that plan and payor source. Non-wage parity benefits need to be separated out. And do you need to report overtime hours?

The REAL reporting deadline

Mordechai also warns that your deadline may be much sooner than you think. Remember that payors need to submit a certification by June 1st, too. In that certification, they attest that they “received, reviewed, and assessed” every compliance statement from every provider. They need time to do that.

“I know of at least one insurance plan that’s asking for the certification by April 15th,” says Mordechai. “More will follow suit. And keep in mind that CPAs are also dealing with tax season. You can’t just dump the LS301 on them without warning.”

No worries

“The bottom line is this,” Mordechai concludes. “You need to work with a wage parity vendor that understands wage parity law and provides 100% kosher benefits.

“There have been many audits and subpoenas already, and now there will be even more scrutiny. An experienced, transparent vendor will give you all the necessary information to pass your audit.”

Shaya Sternhill, Melody Benefits Head Of Business Development & Sales, notes that Melody’s monthly reports already give clients much of the information breakdown required for the LS300:

- Total wage parity spend

- Wage parity spend broken down by benefit

- Complete benefits usage report for each employee

“We do the work for you,” he says.

And beyond that, “we won’t rest until our clients have what they need,” says Shaya. “We’re developing new reports geared explicitly for the LS300. We’re speaking to attorneys, asking questions so we can advise our clients and give them the correct information.

“Call us, and we’ll walk you through the process.”